Help to Buy

If you are saving money to buy new home, you can save more deposit than you think. .

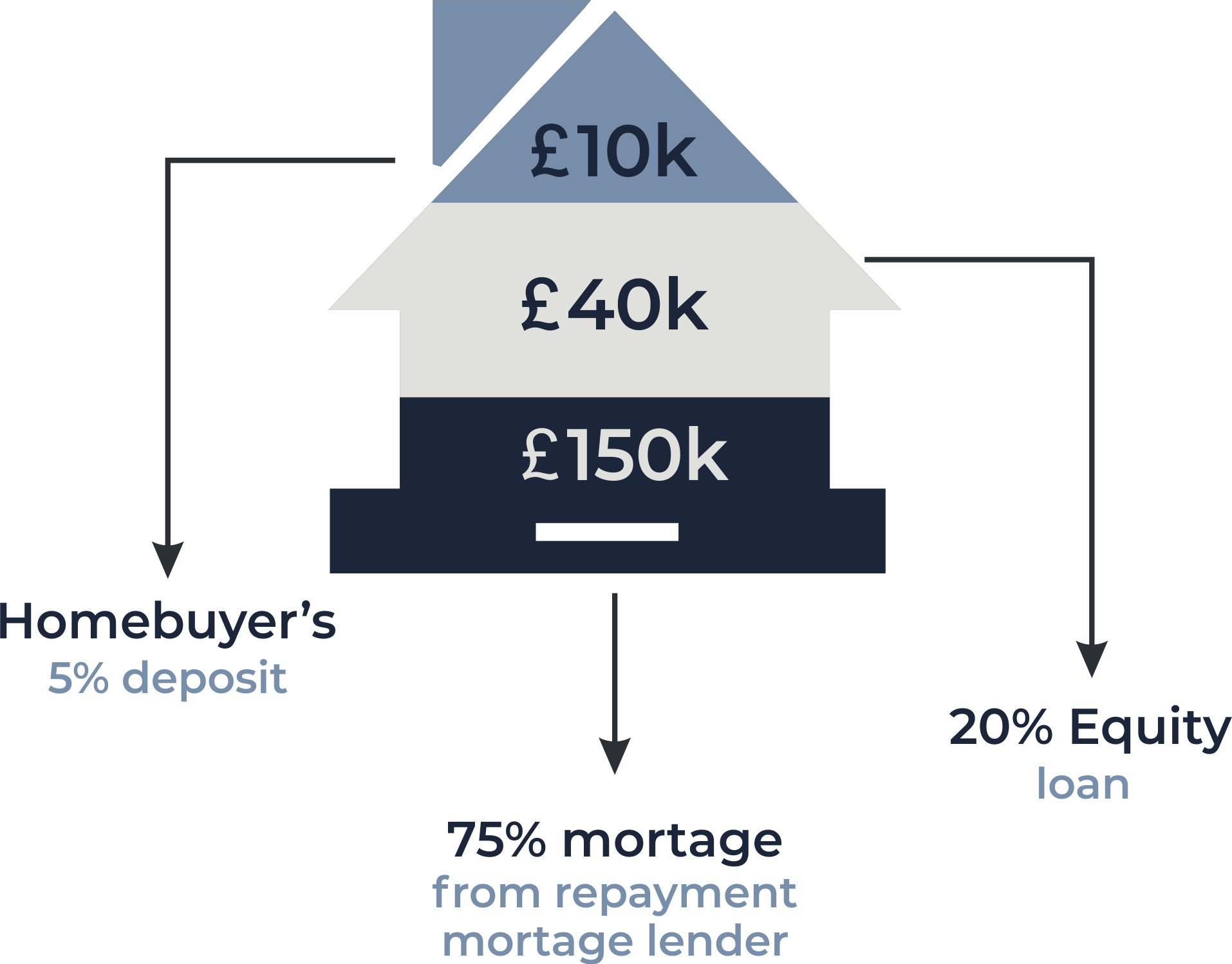

Help to buy is a government undertaking scheme that helps hard working people to save more on their money. Don’t miss the opportunity to save more on your deposit. Help to Buy is a government organised scheme that can help you to buy your first home, or if you are moving up the ladder.